EU and Spanish Pork Markets

Mercedes Vega, General Director for Spain, Italy & Portugal

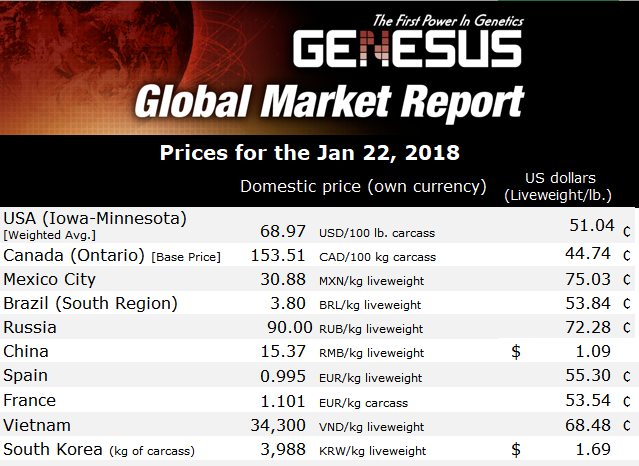

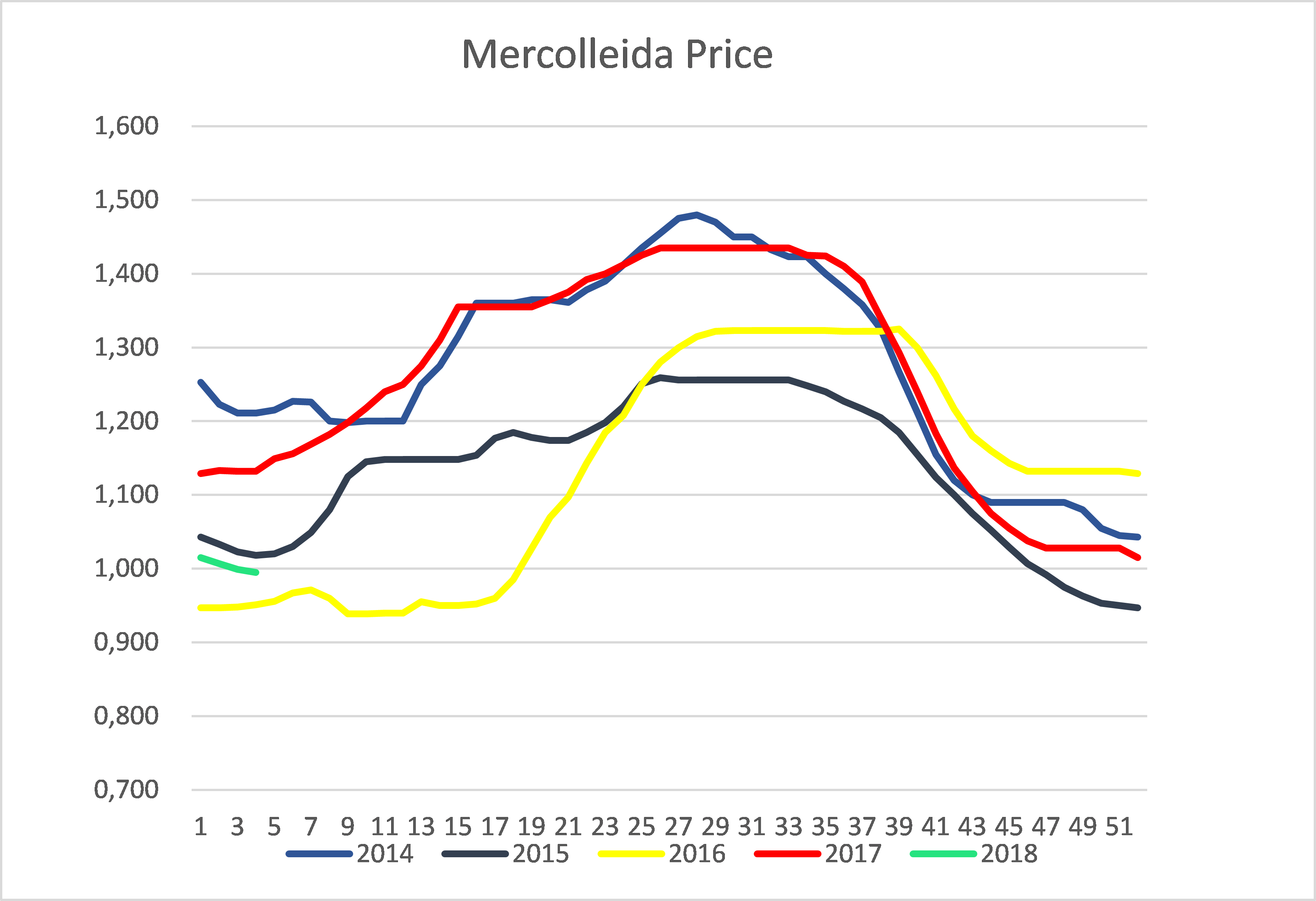

The Pork price for the Spanish market has ended 2017 at € 1,015 / kg live weight, above 1€ but bordering this. 2018 has already come down from the psychological barrier of 1€ to 0.995 / kg live weight. The average price for 2017 was € 1,261 / kg live weight compared to € 1,130 / kg live weight for 2016.

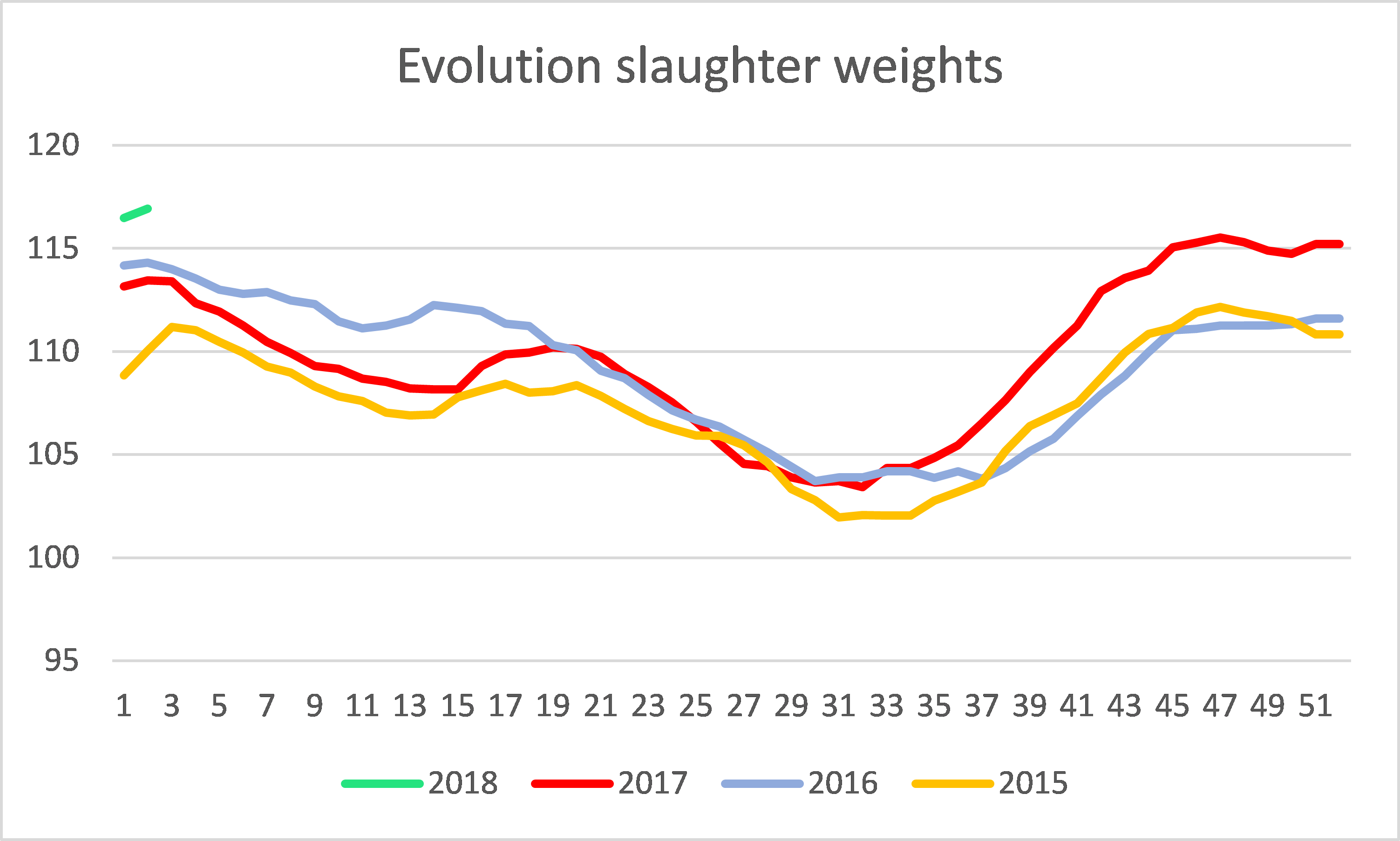

However, in terms of slaughtering weights, the averages have been increasing every year, with 107.6 kg in 2015, 109.2 kg in 2016 and 109.6 kg in 2017.

These data demonstrate that 2017 has been a year in which both producers and packing plants have had benefits. It has produced more hogs and the slaughterhouses have absorbed that production increasing the sacrifices. The production of pork has increased, and all this meat has been commercialized, without the need to fill the freezing chambers.

This weight gain is partly originated from the changing trend of production. Little by little, it is going away from a product in which more than 90% was based on animals finalized with the race Pietrain (speaking of only two years ago), where only the “amount” of meat mattered without considering the “quality” of the meat.

Now the trend is to finish with Duroc breed, whether pure or not and looking for a better meat quality. (marbling, color). In the first half of 2017 we were already at 17% of the pigs slaughtered having Duroc blood, regardless of the production of the Iberian pig, (according to SIP Consultors data)

With these data, and the trend that is being observed in the Spanish market, we can venture to say, that the current production with Duroc , pure or not, as finishing boars already exceeds 30% and growing.

This growth is due to both the domestic market and export.

In the domestic market, (which accounts for almost 50% of production), we start to see pork and hams with the distinction of Duroc meat or Duroc ham, and the consumers are pushing for more.

There is no doubt that export markets such as Japan and Korea demand quality but a big change is that China started also to demand pork meat with better eating attributes.

On the other hand, from January to September 2017, pig exports are over 2 million tons. This has exceeded 4,534 million euros. Represented 86% in value of the total exports of the Spanish meat sector and 9.6% of total agri-food exports from Spain (Data from DATACOMEX, prepared by INTERPORC, Interprofessional of the White Coat Porcine). Already present in more than 120 countries.

With these volumes of production, Spain has consolidated more than 4 million tons, in 2017, and ranks as the fourth producer of pork meat in the world, behind China, USA and Germany.

Categorised in: Featured News, Global Markets

This post was written by Genesus