Genesus Global Market Report China

Lorne Tannas, General Manager China, Genesus Inc.

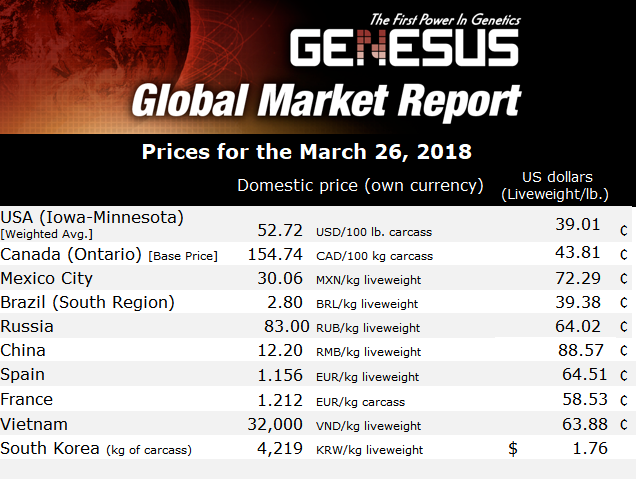

As we enter the second Quarter of this year we have seen a real drop in pricing from the beginning of this year. Some producers are losing between 300 and 400 RMB per Market hog. This comes a bit of surprise as markets were expecting steady pricing throughout the year. This drop-in pricing has been linked to the Chinese Spring Festival. Consumers tend to buy specialty items such as fish, sea food, beef and home-made sausage that is a tradition during Spring Festival. Although China has one fifth the worlds population it has just under half the worlds pork consumption. It just shows what any shift in consumer eating habits can have on the market even with a population as big as China.

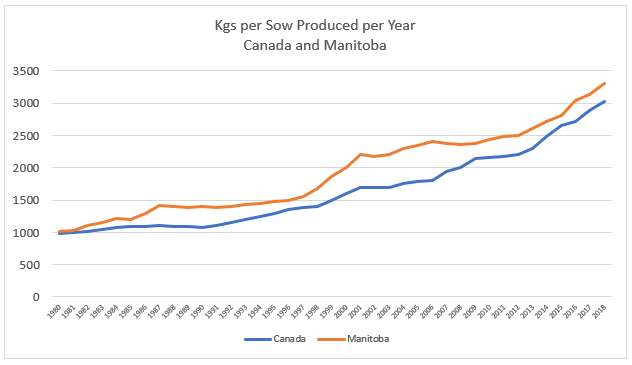

It has become much more difficult to predict the industry turn. Litter size has gone up from 16 to 20 PSY and slaughter weights have risen to 120 Kgs. To what degree the industry has shifted to these new standards is hard to predict. If we look at the industry in Canada, we can only predict that what happened in Canada is now happening in China.

What has happened over the last 38 years in Canada – We’ve seen sow productivity gone from 1000 Kgs produced per year to over 3000 Kgs produced pre-year from her offspring. We see a number of farms in Canada with over 3,500 Kgs produced annually by the sow. Same trend happening now in China.

Low prices mean producers will continue to get out of the market though better production means the same amount of Kgs of production can be produced. China has advanced very quickly but it is difficult to predict where they are on this development line or if they have peaked.

One producer said, “we will just have to eat our way out of this low price” and knowing the Chinese love for pork they probably will. It will be interesting to see if the price rallies over the next quarter or if the price will drag out like in 2013/2014.

Categorised in: Featured News, Global Markets

This post was written by Genesus