Simon Grey - General Manager Russia, CIS and Europe.

The pig price in Russia has fallen to 92 Roubles ($1.43) per live kg. Half carcasses are selling for 140 Roubles ($2.19) meaning a margin of 1,436 Roubles ($22.4) for slaughter plants.

For the large integrated producers margins are still good, although lower than over the past few years. December, January and February are the months where in Russia the price is lowest. For the higher cost producers, the winter is not looking good!

New farms continue to be built and stocked and consumer spending pretty static. Increasing supply and no change in demand means generally lower prices. That is unless anything major, like Russian pork being allowed into China, happens.

There is a lot of Government activity in Russia trying to make this happen. The issue still remains that Russia is a country positive for African Swine Fever. Logic says that Russia being 4 times the land mass of Europe, it should not be difficult to regionalise with regards to ASF free regions. As with all things to do with trade agreements, logic does not always work!

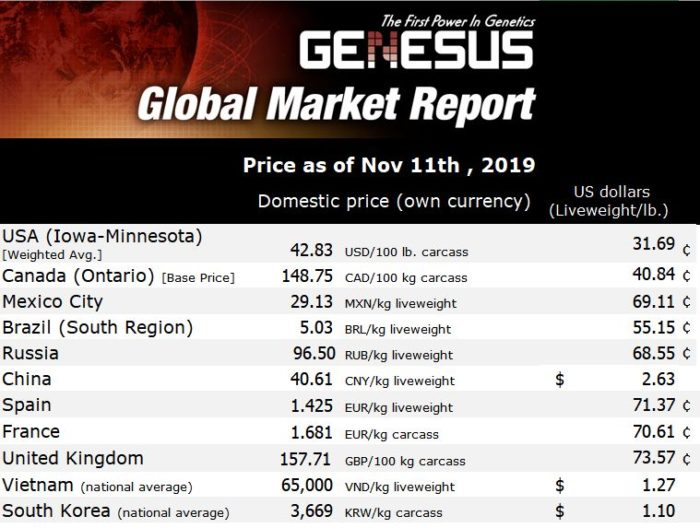

The Russian government is determined to become a net exporter of pig meat. Those that regularly read the Global Market Report’s will know that the lowest pig prices are always in the net exporting countries. USA, Canada, Brazil and some European Counties…

Over the past years, as a Net Importer, Russia has been able to maintain high pig prices. This will no longer be the case. Maintaining a profitable business with low price is going to require quite a large mind shift!

Traditionally there has been a lot of European influence on the Russian pig industry. Many Russian’s look at Europe and in particular Denmark, Holland, Germany and France as being the world’s best pig farmers! All of these countries are losing pig numbers year on year as does Europe as a whole. Many will be surprised that Denmark lost 7.1% of its production from 2018 to 2019, the biggest loser in Europe! The reason is simple, cost of production is too high. There is another reason. The market in Northern Europe is very specific. The most valuable cuts are ham and loin and very lean pigs sell at a premium. This is opposite to nearly every other market in the world where it is the fatter cuts like Ribs, Belly and Neck that sell at a premium.

Europe has only one success story. Spain is the only country in Europe that is growing pig production. There are simple reasons for this. Spain has the lowest cost of production in Europe and the Spanish industry reacted very quickly to changes in global pork market. Spain recognised that the growing export market was Asia and that the Asian market required darker pork with more marbling. Many producers switched from ultra-lean Pietrain and white synthetic boars to Duroc.

There are business lessons here for Russian pig producers.

• Clearly the market in Russia has changed. Failing to change, especially with regards to reducing costs and producing what the market wants will mean only one thing, bankruptcy.

• The North European business model may be the most productive in terms of born alive and pigs weaned per sow per year, but in the pig business this is irrelevant. What matters is throughput and cost of production. In these factors the North American model wins every single time! At the same time Europe is losing production North America has been increasing!

In pig production, 100% of the income is made in finishing and the biggest single cost is finisher food at 50% of all cost! A weaned piglet (all sow and breeding farm costs) is just 21% of total cost of production! Sow feed is 40% of this, meaning that all other costs relating to piglet production are just 12% of total cost!! A simple rule of business is to focus on where you get the best response!!

• The potential export market for Russia is Asia. Asians want Darker pork with high marbling.

Crossing a standard F1 with a white synthetic or Pietrain terminal boar or even a European Duroc bred to be very lean will give only 20% of pork suitable for Japanese market. Crossing a Genesus F1 with a Genesus Duroc terminal boar will give over 90% pork suitable for Japanese market.

• Russia is a fat pig market. The most expensive cut of pork is neck and today one kg of fat has more value than one kg of lean ham!

Another simple rule of business is to produce what customers want to buy. Seems pretty obvious. People want tasty pork. The retail price in Russia proves this. The taste is in the fat. This is why marbled meat is seen globally as best.

There are some bits of the pig industry trying to say correct pH is the more important factor when it comes to taste! This is of course not the case, as science proves. From a sales and marketing point of view all sell ‘correct pH’ would do is confuse the consumer!

When did you last see ‘correct pH beef’ in a butcher’s shop or on a restaurant menu?

Categorised in: Featured News, Global Markets

This post was written by Genesus