Mexico Pork Market Report

Fernando Ortiz

fortiz@genesus.com

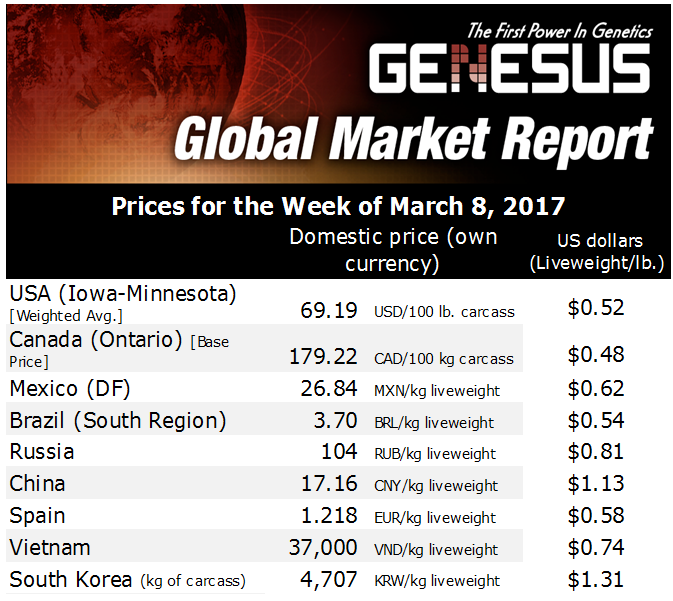

Mexico, as a price taker from US prices, has experienced relatively unusual behavior over the last few months, with higher prices compared to its North American counterpart. However, during recent weeks the price has started to stabilize a few pesos lower than it was.

Some of the causes for this is happening are:

- Vespers of Lent – seasonally during Lent and Easter time, consumption get lower.

- Diseases – talking to a senior swine vet this week, he mentioned that DEP and PRRS continue to be of big impact on areas like Jalisco, Guanajuato, Sonora and western Mexico in general. Less pigs equal highest prices.

- Exchange rate – Mexico peso devaluation on front of the American currency has made pork import into Mexico a little weaker (specially hams and shoulders)

In spite of all the above, the price in Mexico remains relatively strong and producers are still making money. However, the price has been coming down from 34 pesos/kg ($0.79/lb) (Dec 2016) to about 27 pesos/kg ($0.63/lb) today.

One positive thing to keep markets up is consumption. Mexico has increased its per-capita pork consumption by two kilograms over the last decade. You can do the math based on a population of 110 million people. This deficit has been filled by imports, mainly from the United States and Canada. At this time, the EU (Spain) is pursuing a slice of this pie as well. Per-capita pork consumption in Mexico is currently about 18 kg.

Cost of production has remained steady due to stability of grain prices and commodities in general. People in the industry look positive and optimistic for the rest of the year.

One interesting point to highlight here is that in Mexico, some of the largest pork producers are also the largest egg producers. They have faced a terrible last year of losses on their laying hens business. Losses that have been cushioned in part by profits from their pig business.

On the other hand Mexican pig producers are constantly challenged by factors like:

- Exchange rate and commodities fluctuation – Since Mexico is a country that depends on imports of grains, these two factors are of higher risk

- Financial cost – Credit accessibility and bank interest rate are too high in Mexico – around 12 to 13%.

- Pork import (ham and shoulders mainly) – At a lower cost than produced in Mexico. From 650,000 tons of meat imported/year, 90% are ham and shoulders from United States mainly.

- NAFTA – uncertainty about what is going to happen

- The demand of farm labour is declining – The expansion of the larger producers is being done at the expense of the small and medium producers causing a displacement of labor of the farms towards the cities (social problem)

Again, in general the overlook of the market is positive and as we head into summer, I believe we will continue towards an overall higher price.

Categorised in: Featured News, Global Markets

This post was written by Genesus