Mercedes Vega, General Director for Spain, Italy & Portugal, Genesus Inc. mvega@genesus.com

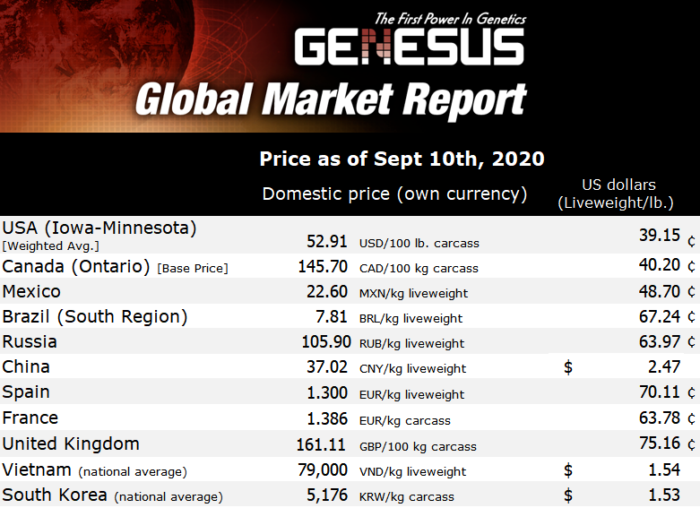

After eight weeks of same price, Spain is still at 1.3 € per kg live weight, the lowest value of the last five years, except for 2018. As we can see in the table below the average price until this week is much higher than in previous years. This is because we started from a remarkably high value at the beginning of the year. During the summer months, as usual, the carcass weights are lower, but still the heaviest in the last five years.

.png)

Even though there is now more demand than supply and the usual summer lower weights, the price has not risen due to lower pig prices in other European countries like Germany, France and the Netherlands.

The average year to date value difference between Spain and Germany is not significant, but at this moment this is visible 1,3€ in Spain vs 1.1€ in Germany (per kg live weight).

.png)

Traditionally fall brings lower prices, but this year all the schemes are broken, and now prices are expected to go up given the market situation.

The major difference between Spain and the rest of Europe is that Spain did not have closure of packing plants by the Covid-19. There has been processing limitation due to sanitary measures implemented, offset by the processing capacity growth observed earlier in the year, great efficiency, and closure of plants in the north of the EU.

From January to June 2020, despite the pandemic, the processing of hogs has increased by 3.19% re number of hogs and 5.5% re weight.

.png)

As far as exports are concerned, we can say that in the first six months of 2020, “Extra-Community Exports” of the Spanish pork sector continue to exceed “Intra-Community Exports” in volume and value (54.5% in volume and 51.4% in value).

More than 74% of exports (volume and value) are distributed among eight countries: China (first place), followed by France, Japan, Italy, and Portugal.

In 2019 – 663,892 tons were exported to China (27.2% of exports) with a value of 1,441,258 thousand euros (23%), while this year just during the first half of the year 539,627 tons were exported with a value of 1,192,379 euros

All this shows that 2020 is a good year for the Spanish pork sector, though there still is a lot of uncertainty because caused by ASF and the Coronavirus pandemic that is devastating the planet.

INTERPORC: The Spanish pork sector very committed to the environment.

The Organization Interprofessional White Hog Agri-food (INTERPORC) stresses that the water footprint to produce a kilo of pork (meat or products) in Spain has dropped by 30% in recent years, with a total amount today of 5,950 liters, drinking water representing only 8%.

Spanish farmers are committed to reduce the water footprint by 50% over the next three decades within the goal of achieving a neutral climate impact by 2050.

Italian Market

In Italy, the market continues with sustained price increase. The certified pigs for Parma ham (176 kg average live weight) are at 1.468-1.498 euros/kg. Pigs out of Parma certification are priced at 1.286-1.316 € per kg. The 25kg feeder pig is priced at 64 euros.

There is a very dynamic demand, but supply is totally insufficient to cover it. The meat market is in a strong recovery, although the packing plants are still not making any money. That is why there is a lot of resistance to accept the maximum rise that producers are asking for.

Categorised in: Featured News, Global Markets

This post was written by Genesus

.png)