LYLE JONES, DIRECTOR OF SALES CHINA

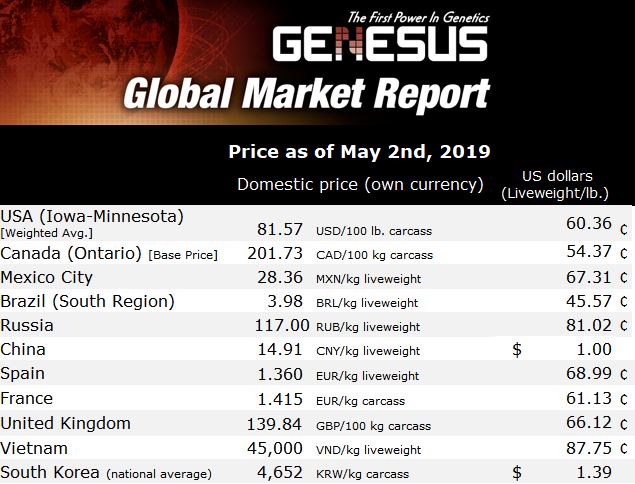

The April pig price was 15.11rmb per live kg ($1.02/lb.). Reports in recent days actually show a softening in the market to 14.91rmb/kg.($1.00/lb). One might ask why the pig prices within China are so stable amid reports of rampant spread of ASF and significant liquidation of herds. We believe this is an indication that heavy flow of pigs going to the slaughterhouses due to ASF continues. Reports are some slaughterhouses are running double shifts to accommodate the numbers of animals being marketed at this time.

While the overall inventories of the breeding herds and commercial production farms is steadily declining, there is a surplus of pigs going to slaughter resulting in these relatively flat pig prices.

On the other hand, we are hearing of weaner pig (15kg/33lb) prices going at from 800 rmb ($119) to 1000 rmb ($149) per head on the open market. So there is a big disparity between the price of pigs going to slaughter and the price for weaners that will be refilling barns. Obviously, this scenario can only go on for so long until the flow of pigs to the slaughterhouses begins its decline and demand for pork pushes domestic pig prices upwards.

When will the impact hit?

We think that largely depends upon how much cold storage there is available when flows to the slaughterhouses begin to shrink.

In the meantime we are reading reports Chinese buyers becoming very active in Global Export markets and are increasing imports of carcasses significantly from Canada, the USA and abroad.

According to reports and information provided by the Ministry of Agriculture of China, ASF has now spread through all China in only 9 months.

During a recent visit to China, it looks to us that the spread in the North and Central is slowing down. This is likely due to an intense focus now upon Bio-Security that is having an effect and also empty barns and fewer pigs in these areas that were affected first.

In the south it seems the spread has been picking up in provinces like Guangdong, Guangxi and Fujian. Everyone’s focus is upon protecting their farms and learning and adopting Bio-Security procedures.

Bio-security is the most important daily task- nothing else matters. Even some farms not yet affected by the disease have paused breeding to focus upon perfecting these procedures.

We hear of very elaborate bio-security systems being developed with not only physical barriers but special surveillance cameras with uplinks to satellites. These systems feature custom software to provide verification that these procedures are being fully implemented.

As a result of these intensive efforts to adopt and master bio-security there are reports that other diseases are declining and overall herd health improving. Thus, we are seeing some positive results that will provide benefits for the future from the battle against this unfortunate disease.

Back to the question of when the impact of all this will affect domestic pig prices in China? No one really knows for sure but there has been a lot of speculation upon this topic because it shall also continue to impact Global markets.

In talking with an analyst recently, indications are we may begin seeing real movement in pig prices toward the end of this summer. It is also anticipated that domestic pig prices in China may reach extreme upper limits surpassing all-time highs perhaps starting in January 2020.

Categorised in: Featured News, Global Markets

This post was written by Genesus