Overall, global pork trade in 2017 is stable, with a boost in production from the United States being mainly absorbed by main import markets in Asia, supporting international hog prices according to a recent global pork quarterly report by Rabo-Research Food & Agribusiness.

In the past five years, world pork production has increased by 3.854 million mt with the United States contributing to the largest growth at 1.290 million mt. European Union production climbed 924,000 mt, Russia’s production was up 825,000 mt and Vietnam’s production increased by 443,000 mt compared to five years ago.

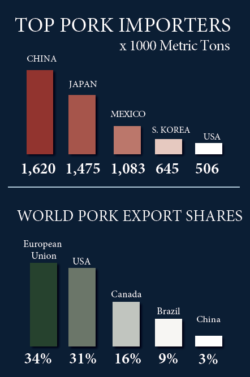

The EU leads the way exporting 45% of the world’s pork, with the United States coming in second at 27%, followed by Canada at 14% and Brazil at 9%. Currently, the EU pork industry is thriving with record exports through February 2017. However, climbing hog prices are slowing down the pace and limiting its competitiveness. The spread between the United States and the EU is the widest since 2009, reports the U.S. Meat Export Federation. “The EU continues to be very aggressive in its pursuit of new trade agreements and in its efforts to modernize existing agreements — some of which are with large pork-importing countries,” states Joe Schuele, USMEF vice president of communications.

Brazil is quietly building it global pork foothold with increases in all the main markets, specifically China. Also, a favorable currency and export-focused industry, Canada’s pork sector is performing well this year, notes Rabobank.

While China produces the most pork, it also consumes the most. Importing 40% of total pork, China is the most sought after market. Market experts estimate that China will import 3 million tons of pork this year, as the country recovers from a massive reduction in sow numbers and the government promotes larger production models.

Rising consumption in the second and third largest importers of pork is good news for exporters. Japan’s appetite for pork increased for the third year in a row while its domestic production declined. In the first quarter of 2017, Rabobank reports pork exports to Japan from the United States, Canada and Mexico grew 8%, 11% and 13%, respectively, whereas pork shipments from the EU remain flat.

Pork consumption for the third largest importer of pork — Mexico — is anticipated to grow 2.8% in 2017. For the winter of 2017, Mexico hog producers battled another round of porcine epidemic diarrhea virus hindering pork production, but the impact thus far is not as harmful as the outbreak in 2016. According to Rabobank analysts, Mexico’s pork imports are already at a record high this year. Trade discussion between the United States and Mexico could open the door for other pork-producing countries to capture a share of the marketplace.

The global pork landscape is changing to serve the demands of the consumer worldwide. Gone are the days of producing as much pork as possible and selling it to the highest bidder with productivity, volume and price of an increasingly “lean” product being the key variables.

Traditional marketing programs are going by the wayside. Consumers are asking for full tracking of the supply chain from farm to table and the story behind producing the pork on their fork, notes Rabobank. So, pig farmers from around the global are struggling with supplying the changing consumers’ demand while producing pork within restrictive government regulations.

Keeping pork at the center of the plate comes down to taste, price and safety. Research after research shows that consumers select food items based on taste and price with the safety of the product trumping all other preferences.

The future of selling pork around the globe is the quality behind the brand and understanding the consumer. Philip Seng, president and chief executive officer of the USMEF, says, “It used to be when we talked about pork internationally we talked about all the nutrients. There are a lot of consumers that define the food they eat by what is not in the food they eat.”

In order to sell pork worldwide, Seng says you have to understand the mind of the consumer and the retailers’ policy that reacts to the consumer or actually shapes the minds of their shoppers in the targeted marketplace. Each global market has unique consumers along with retail standards.

U.S. hog farmers can produce pork efficiently and safely. Returning customers — Mexico and Japan — are a testament to the consumer response to U.S. pork. Excellent production and modest growth are driving more pounds of pork to sell. While production numbers seem to be hard to pinpoint, demand is remaining strong, with exports jumping 18% in the first two months of this year.

Producing the pork is not a problem for U.S. hog farmers. The effort is to sell the extra pounds of meat — a task all pork exporters want to accomplish. Each country has its barriers in foreign markets. Some countries have price advantages while others have the right product for the right market. Moving forward, one thing is certain — the competition is not going away, and it will take being on top of the game to compete successfully.

article by Cheryl Day, National Hog Farmer

Jim Long, president and CEO, Genesus Inc., offers insight into the global changes in the pork industry and the role all hog farmers play in producing pork for the world. “We believe size is not a limitation for people to be in the swine business. The technology is available to everyone. There is no barrier of entry. They have to realize they can compete,”

JIM LONG AgBIZ 705 from Cheryl Day on Vimeo.

Categorised in: Featured News

This post was written by Genesus