Pork Commentary

Jim Long President – CEO Genesus Inc. info@genesus.com

US dollar Index

Canadian Dollar

August 10, 2015

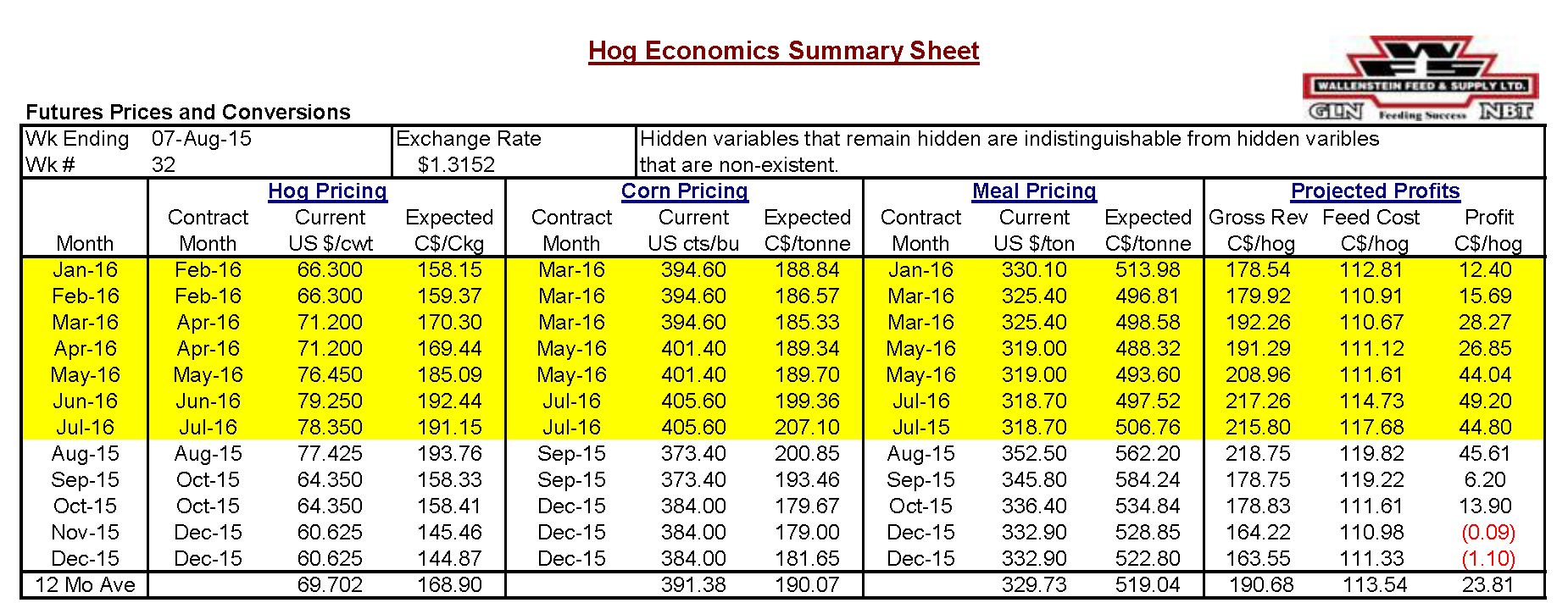

One of the factors affecting US pork export sales is the increase in value of the US dollar reflected in the US Dollar Index – a benchmark relative to other major currencies. A year ago, the US Dollar Index was 81, last week it surpassed 98. A 17 point, or about 18% increase. This is making US pork more expensive in relative terms for importers. The high value of the US dollar index reflects the global confidence in the US economy and prospects. The Canadian dollar over the last year has lost value compared to the US dollar. A year ago, the Canadian dollar was trading at 91¢ to the US dollar. Last Friday the Canadian dollar was 76¢ to the US dollar – a 19% decline. This devaluation is helping Canadian swine producers stay competitive. The Canadian swine industry follows US pricing with a negative basis but the Canadian market tracts closely to the US market. A reflection of this is profit potential, over the next year in Canada is a projection of profitability done weekly by Robert Hunsberger of Wallenstein Feed Mills. This past week the projection indicated a $23.81 per head profit for average production the next twelve months. This is using current exchange rates. The point is, without the 19% devaluation in the Canadian dollar the last 12 months we doubt if Canada’s producers would have profit prospects using current future pricing.

Other Observations

Other Observations

- China’s hog market was $1.31 USD per pound liveweight last week, up from 85₵ a pound in mid-April (17.94 rmb/kilo) a $100 plus per head increase. How high will it go? We projected $1.25 when it was 90₵, wrong again, not bullish enough!

- We expect it’s a two month lag from ordering of pork before it is shipped to export markets like China. The China hog price was significantly lower in April than now. US June pork exports were probably sold in April to China. It takes time to start an avalanche. We expect it’s starting to happen. US pork cut–outs were over 90₵ per pound last Friday. China will be buying lots of pork and it’s started to happen.

- USDA reports that last week cash early weans averaged $21.55. This price is significantly below breakeven for the sow producer. We expect lower prices have taken the edge off expansion. USDA reported that the US marketed 32,000 more sows in June than a year ago (219 – 251). That tells us there is probably no net expansion ongoing of the sow herd.

- Abracadabra! – PED disappears. Isn’t it amazing how fast PED hit and how fast it has been a next to non-factor? Looks like it was a virus that ran its course and disappeared. Better bio-security? Maybe, but not likely. PED vaccine makers might have invested a lot to end up with no market.

Finally, from Monday’s China Daily Front Page Story…

Finally, from Monday’s China Daily Front Page Story…

Pork Prices Propel Rise in Inflation

But business managers in nonfood sectors continue to fret over deflationary pressures

Housewives compare prices every day, including Zhang Ming, a 60-year-old retired woman who frequents a supermarket in Beijing’s Fengtai district.

On Sunday morning, she spent 45 yuan ($7.30) on 1 kg of pork fillet. “It’s amazing considering that it wouldn’t have cost 35 yuan just a couple of months ago,” she said.

The National Bureau of Statistics said that last month the average price for pork in China shot up by 16.7 percent year-on-year, along with a price increase of 10.5 percent for all vegetables.

Pork and vegetables are the two major factors that have taken the nation’s consumer inflation to a nine-month high, the bureau said.

Driven by food items, China’s consumer price index, its general gauge of inflation, saw a year-on-year rise of 1.6 percent last month, compared with an increase of 1.4 percent in June, and with a very low level of 1.3 percent reported in the first half of the year.

Meanwhile, business managers, apart from those in the food industry, continue to agonize about the deflationary pressure they are facing.

To us, the story of higher pork prices means that China’s government will not discourage the importation of pork.

Categorised in: Pork Commentary

This post was written by Genesus